Overview

This page explores the critical elements required for achieving a comprehensive compliance strategy in the context of international financial transactions. It covers the essential processes of Know Your Customer (KYC), screening, risk assessment, and rule engines, each designed to address specific compliance requirements, minimize risks, and streamline operational workflows. By understanding how these components work together, businesses can build robust systems that not only ensure adherence to legal and regulatory standards but also foster customer trust and operational efficiency.

Financial Transfer Challenges

In today's highly interconnected global economy where financial transfers are the backbone of global commerce and personal transactions, international money transfers play a pivotal role in shaping economic landscapes across continents. These transactions serve as the lifeblood of international trade, investments, and business expansions, ensuring a seamless flow of capital across borders and driving economic growth worldwide. However, these processes face several challenges that can compromise their security, efficiency, and compliance:

- Fraud and Money Laundering: Criminals exploit loopholes in financial systems to launder money or commit fraud.

- Regulatory Non-Compliance: Failing to meet financial regulations can result in severe penalties and reputational damage

- Operational Inefficiencies: Manual processing of financial transfers can be slow, error-prone, and resource-intensive.

- Risk Management Gaps: Insufficient risk assessment can lead to undetected suspicious activities.

To overcome these challenges, organizations leverage advanced frameworks and cutting-edge technologies that integrate electronic Know Your Customer (eKYC) processes, risk assessment tools, and intelligent rule engines, screening.

These elements function together to create a comprehensive compliance framework, ensuring that organizations detect and mitigate risks in real time, follow regulatory guidelines, and protect against financial crimes. While they are distinct components, their ultimate goal aligns with compliance requirements.

Compliance

Compliance in financial transfers ensures adherence to laws, regulations, and industry standards to prevent illegal activities and maintain trust in the financial system. Key considerations include:

- AML and CFT Compliance: Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT) regulations are critical in financial transfers.

- Transaction Reporting: Ensuring accurate reporting of large or suspicious transactions to regulatory authorities.

Know Your Customer (KYC)

KYC processes help financial institutions verify and understand their customers to minimize risks such as fraud and identity theft:

- Identity Verification: Ensures that customers are who they claim to be using documents or digital verification tools.

- Risk-Based Approach: Tailoring due diligence efforts based on the customer’s risk profile.

- Continuous Monitoring: Tracking customer behavior over time to detect and prevent fraudulent or illegal activities.

Risk Assessment

Effective risk assessment is vital in identifying and mitigating threats to financial transfers:

- Risk Identification: Identifying potential threats, such as high-risk jurisdictions or politically exposed persons (PEPs).

- Dynamic Risk Scoring: Using data analytics to assign risk scores to transactions or customers.

- Proactive Mitigation: Deploying safeguards, such as transaction limits or additional approvals, for high-risk scenarios.

Rule Engine

A rule engine automates decision-making in financial transfers, ensuring speed and accuracy while maintaining compliance:

- Automated Monitoring: Applying rules to flag unusual activities in real-time (e.g., "transactions above $50,000 require manual approval").

- Customizable Rules: Adapting to evolving regulatory requirements or business needs.

- Scalability: Handling large volumes of transactions without compromising performance.

Screening

Screening is a critical process in financial systems to identify and prevent illegal or high-risk activities. It involves checking individuals, entities, or transactions against predefined lists and criteria to ensure compliance with regulations and mitigate risks. Key aspects include:

- Sanctions Screening: Verifying entities against global watchlists such as OFAC, UN, or EU sanctions lists to prevent dealings with restricted parties.

- PEP Screening: Identifying Politically Exposed Persons (PEPs) to apply enhanced due diligence and monitor potential corruption risks.

- Adverse Media Screening: Scanning news and media outlets for any negative information linked to individuals or entities that may indicate risk.

- Real-Time Transaction Screening: Continuously monitoring transactions to flag potentially suspicious or non-compliant activities.

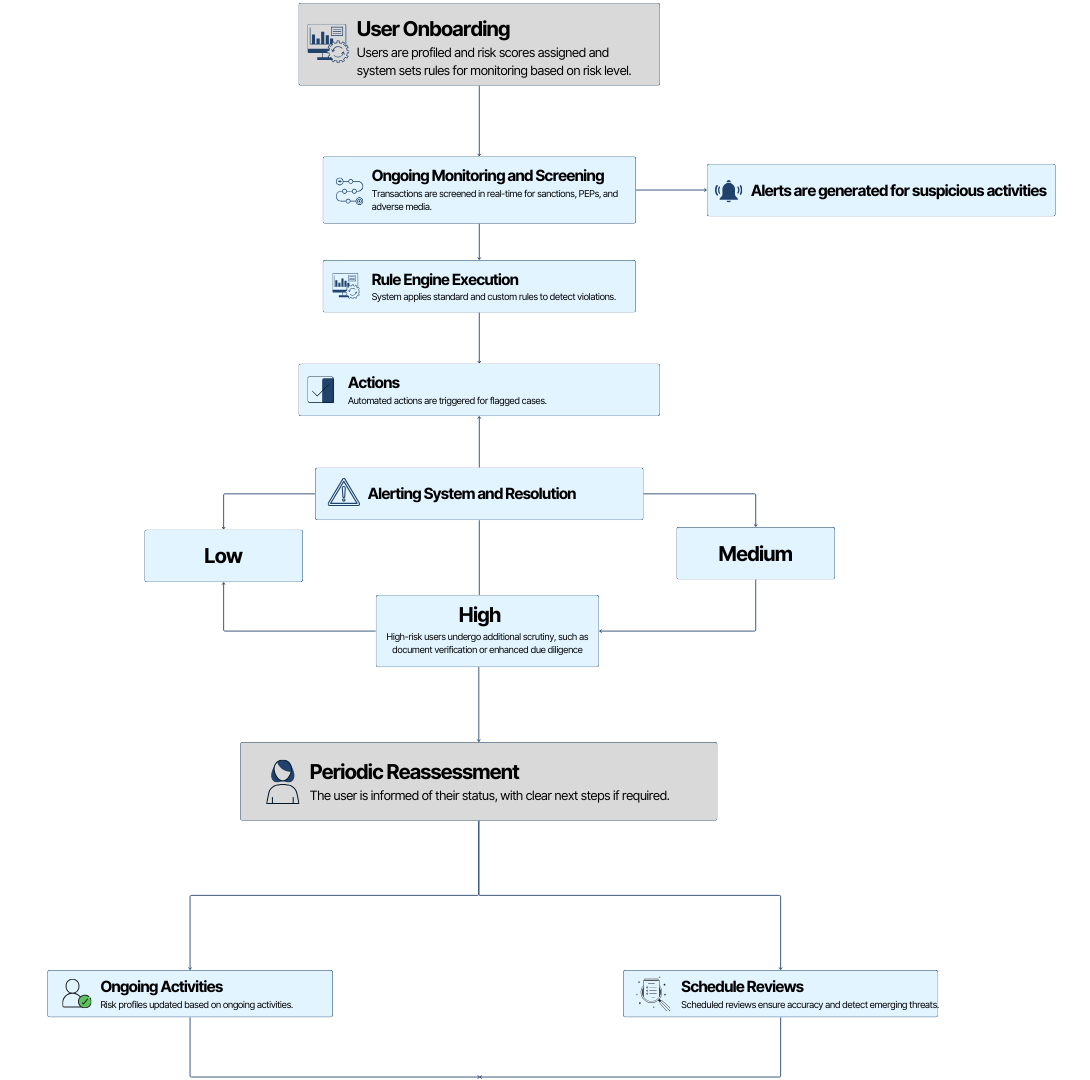

Diagram Flow

How Skaletek Can help to streamline your KYC process ?

Skaletek's comprehensive platform combines KYC, screening, risk assessment, rule engine to deliver a seamless, secure, and efficient solution for businesses navigating regulatory landscapes. Leveraging AI-driven identity verification, real-time transaction monitoring, and automated risk scoring, Skaletek ensures rapid customer onboarding while maintaining the highest data security standards.

The platform's rule engine empowers businesses to define and implement custom policies, enabling automated decisions based on predefined conditions such as transaction thresholds, geographic restrictions, and customer risk levels. Integrated risk assessment tools dynamically evaluate threats, providing actionable insights to mitigate fraud and suspicious activities effectively.

Whether you're in banking, fintech, or insurance, Skaletek’s adaptable and globally compliant system helps reduce regulatory penalties, enhance operational efficiency, and strengthen customer trust.