Introduction

What is KYC (Know Your Customer) ?

KYC (Know Your Customer) is a vital process used by organizations, particularly in financial services, to verify the identity of customers and assess risks associated with illegal activities such as money laundering, fraud or terrorism financing. It is a cornerstone of regulatory compliance and risk management frameworks, ensuring trust, transparency, and security in financial transactions.

KYC is mandated by global regulatory bodies like the Financial Action Task Force (FATF) to combat financial crimes and ensure ethical business operations.

Key Components of KYC:

-

Customer Identification Program (CIP):

- Collects and verifies customer details (e.g.,

name,address,date of birth) through official documents such as passports or driver’s licenses. - Confirms the authenticity of these details to establish identity.

- Collects and verifies customer details (e.g.,

-

Customer Due Diligence (CDD):

- Evaluates the customer’s risk profile based on their financial activities.

- Identifies high-risk individuals or entities, such as politically

exposed persons(PEPs).

-

Ongoing Monitoring:

- Tracks customer transactions to detect unusual or suspicious activities.

- Periodically updates records to reflect changes in customer behavior or risk levels.

Why is KYC Important ?

KYC is critical for businesses, especially in regulated industries like banking, finance, and insurance, to operate securely, build trust, and comply with legal frameworks. Below are the key reasons why KYC is essential:

-

Regulatory Compliance:

- Ensures adherence to Anti-Money Laundering

(AML)and Counter-Terrorism Financing(CTF)regulations, preventing hefty fines or legal consequences. - Helps meet international standards set by bodies like the Financial Action Task Force

(FATF).

- Ensures adherence to Anti-Money Laundering

-

Fraud Prevention:

- Verifies customer identities to prevent identity theft, fake accounts, and fraudulent activities.

- Acts as a frontline defense against cybercrime and financial fraud.

-

Mitigating Financial Risks:

- Provides insights into customer profiles and behaviors to assess and manage risks effectively.

- Identifies high-risk individuals or entities, such as politically exposed persons

(PEPs).

-

Enhancing Customer Trust:

- Builds credibility with customers, showing that the organization prioritizes security and transparency.

- Fosters a safe environment for legitimate transactions.

-

Preventing Money Laundering and Terrorism Financing:

- Tracks the source of funds to ensure they are not being used for illegal purposes.

- Flags suspicious activities early and reports them to authorities.

-

Global Business Enablement:

- Ensures compliance across diverse regulatory frameworks for multinational operations.

- Supports secure cross-border transactions.

-

Operational Efficiency:

- Modern KYC systems streamline onboarding processes, reducing manual effort and errors.

- Automation improves turnaround times and lowers costs for businesses.

In today’s global economy, KYC is not just a regulatory obligation but a strategic tool for safeguarding businesses, enhancing customer relationships, and contributing to a more secure financial ecosystem.

Where is KYC Used ?

- Banks and Financial Institutions: For account opening, loan approvals, and transaction monitoring.

- Cryptocurrency Platforms: To verify traders' identities and prevent misuse.

- Insurance Companies: For risk assessment and fraud prevention during claims.

- FinTech and Payment Gateways: To ensure safe payments and user authenticity.

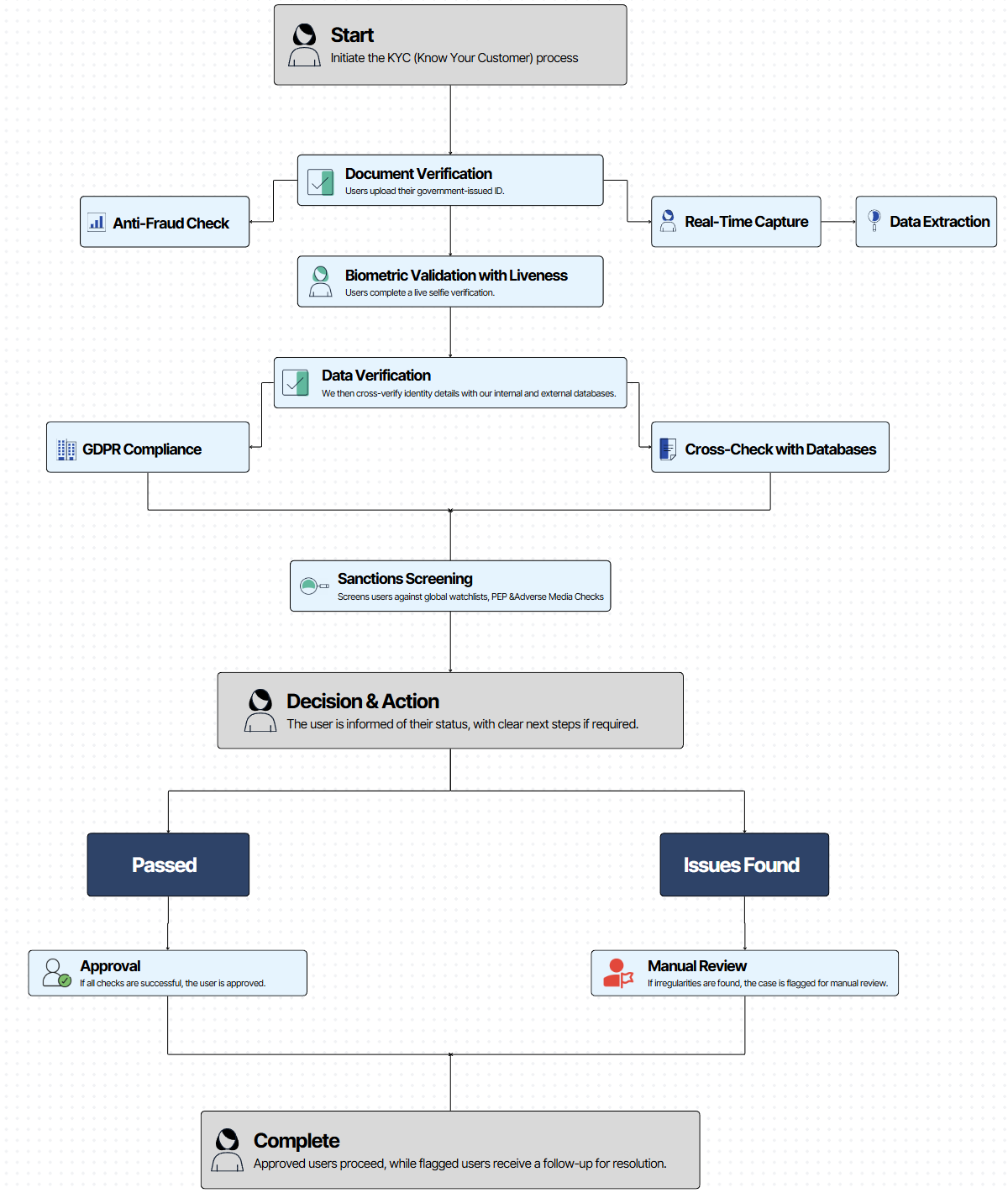

By integating our KYC system, follow the next steps below to complete the KYC process.